The Only Guide for Bookkeeping Okc

The very first step is to define your business requirements. What services do you require from an accounting company? Once you understand what services you require, you can start to narrow down your options.

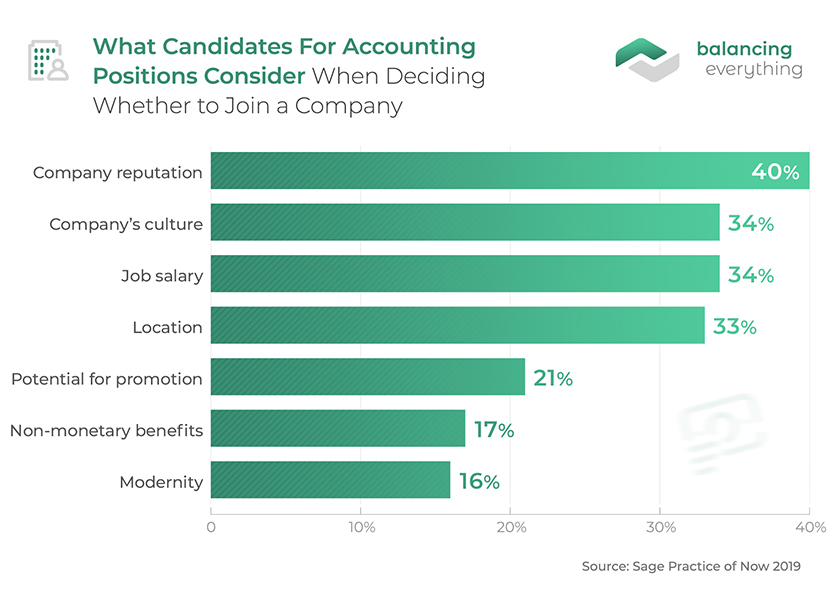

Read online reviews, speak with other company owner, and get recommendations from individuals you trust. This will assist you get a feel for each firm's reputation and. Once you've narrowed down your options, it's time to start meeting prospective companies. During these meetings, make sure to ask lots of concerns.

After satisfying with numerous firms, you need to have a good sense of which one is the.

The Only Guide to Business Consulting Okc

Don't hurry into a choice - take your time and discover the perfect fit for your business. As a business owner, it is very important to partner with an accounting company that can offer detailed services and recommendations. The best accounting firm will have the ability to help you make informed monetary decisions, liability, and optimize your revenues.

Define your requirements. Before you begin your search for an accounting firm, it is back and assess your requirements. What services do you require? What type of recommendations are you looking for? What are your goals? As soon as you have a of your needs, you will have the ability to narrow down your search and find companies that are a.

Do your research study. As soon as you understand what you are looking for, it is time to start your research study. Look for firms that have experience serving. Ask for referrals from relied on. https://www.brownbook.net/business/52477526/p3-accounting-llc/. And, most importantly, check out online reviews. This will give you a good sense of a companies track record and whether or not they are likely to meet your needs.

After you have actually narrowed down your list of possible companies, it is time to arrange assessments. This is your opportunity to fulfill with the companies agents, ask concerns, and get a feel for their culture and worths.

Get whatever in composing. Before you make a last decision, be sure to get everything in writing. This consists of the scope of services, the costs, and the timeline. This will assist prevent any misunderstandings down the roadway and will give you can look here you something to refer back to if there are ever any problems.

Business Consulting Okc Fundamentals Explained

In this case, a smaller accounting firm may be a better fit. They'll be able to supply the personal attention and grow.

6 Easy Facts About Bookkeeping Okc Shown

No matter what size service you have, it is very important to discover an accounting firm that's a good fit. Make the effort to evaluate your needs and pick a company that can provide the level of service and support you require to succeed. When you are trying to find an accounting company, it is very important to consider the location of the company.

You require to discover an accounting company that lies in a location that is hassle-free for you and your employees. If you have an organization that is based in the United States, you should think about an accounting company that is located in the United States. This will make it simpler for you to communicate with the accounting firm and to get the services that you require.

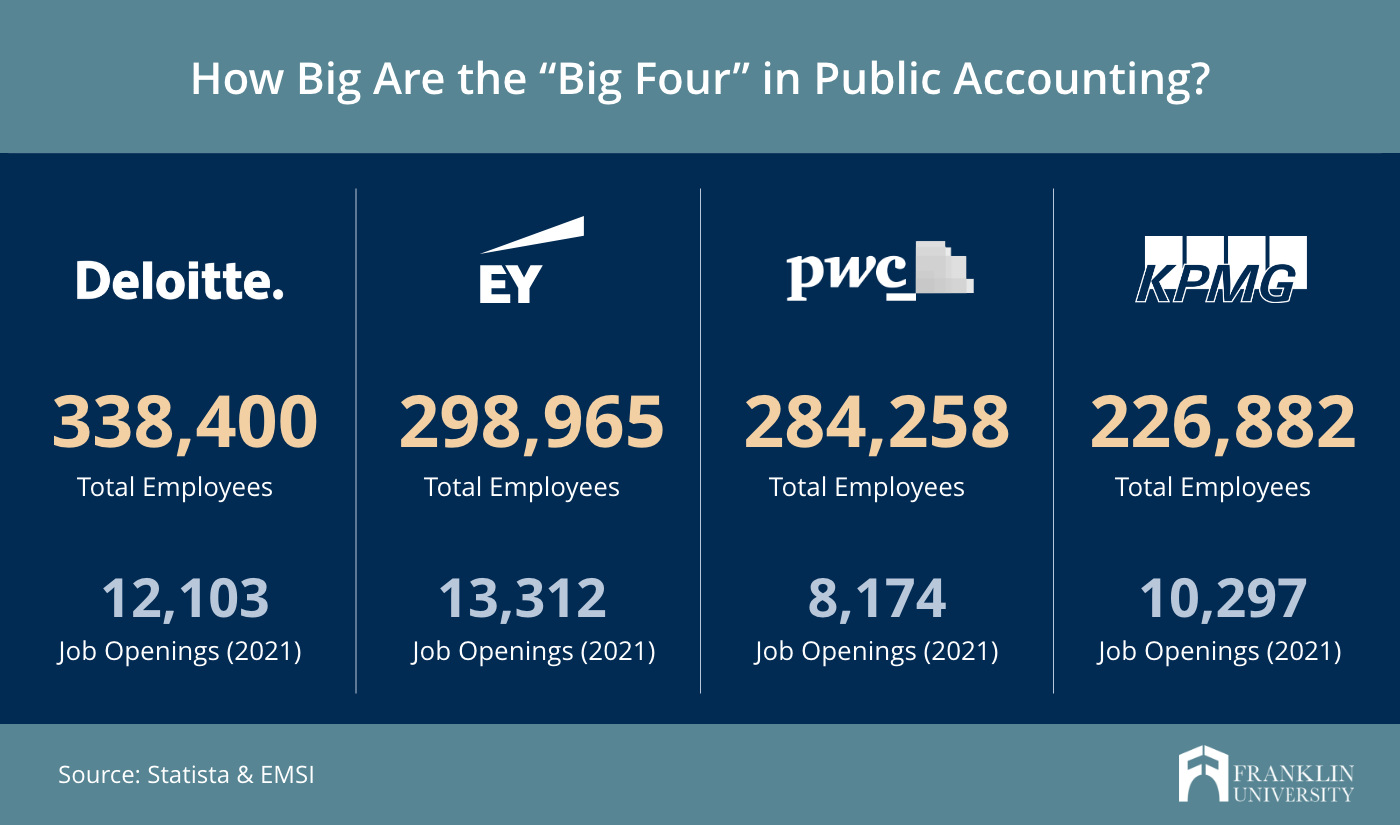

This will make it much easier for you to get the services that you require and to communicate with the accounting company. OKC tax deductions. It is likewise important to think about the size of the accounting company. You need to discover an accounting firm that is big enough to handle your accountancy needs, however not so large that it will be hard for you to communicate with the accounting firm

Some Of Tax Accountant Okc

When you are searching for an accounting firm, you must likewise consider the track record of the accounting company. You require to discover an accounting company that has a great credibility in the market. You can find this info by asking other companies in your industry about their experiences with different accounting firms.

You ought to consider the charges that the accounting firm charges. You can find this details by asking other services in your market about their experiences with different accounting companies.

Not known Incorrect Statements About Tax Accountant Okc

Make sure the firm offers the services you require. How much experience does the company have? Bureau or other websites.

What is the firm's geographic reach? If you have services in several states, you'll need an accounting company that can handle your taxes in all those states. What is the firm's size? A large firm may have more resources, however a smaller sized company may be more responsive to your needs.